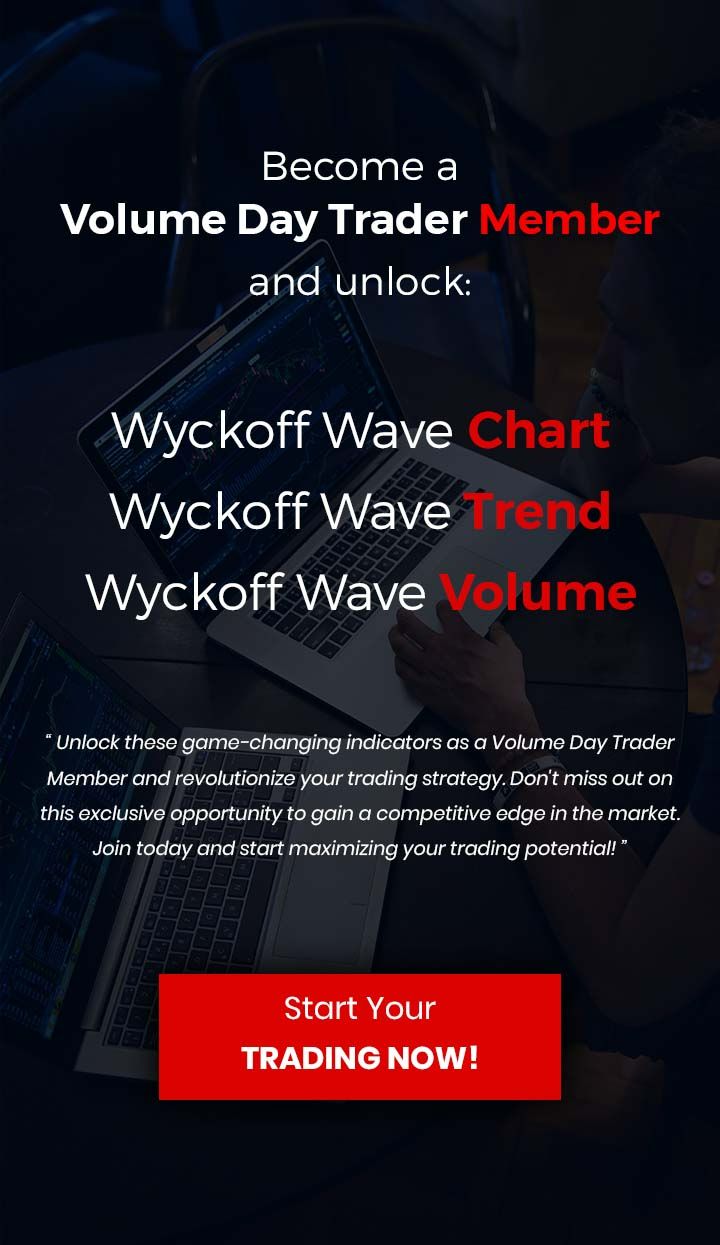

Malicious script in Google and X stole $58m in crypto from over 63k users

A bad computer program called Wallet Drainers tricked people into giving away their money. It did this by pretending to be something else in Google and Twitter. This trick stole almost $59 million in digital money from over 63,000 people in nine months. The trick used about 10,072 websites, and it was most active in May, June, and November.

The fake ads mostly talked about cryptocurrency and NFT giveaways. Some even pretended to be connected to popular projects like Dogecoin. The tricky ads targeted specific regions and used sneaky tactics to avoid being caught during checks. A test found that nine out of ten ads were scams, and more than 60% of them were linked to Wallet Drainers.

“Phishing ads employ redirect tricks to seem legit, like disguising links as official domains that actually lead to phishing sites.”

Scam Sniffer experts

A well-known company that makes secure wallets for digital money, Ledger, warned its users about a problem with certain applications. Some bad people added harmful code to Ledger's app, which helps other apps work with their wallets. This code stole digital money and NFTs from people who used the service.

A company called Chainalysis said that these bad actions are increasing. From May 2021 to December 2023, scammers took about $1 billion in digital money. At first, experts found at least 1,013 locations involved in this tricky activity. Phishing is when a criminal sends fake emails or messages, trying to make you click on a link or give away your account information.

Related Articles

BlackRock designates JPMorgan, Jane Street as Bitcoin ETF authorized participants

Best performing cryptos 2023: which coins thrived despite regulatory pressure

SOL becomes 4th in market cap, overtaking BNB

SwapToday ©

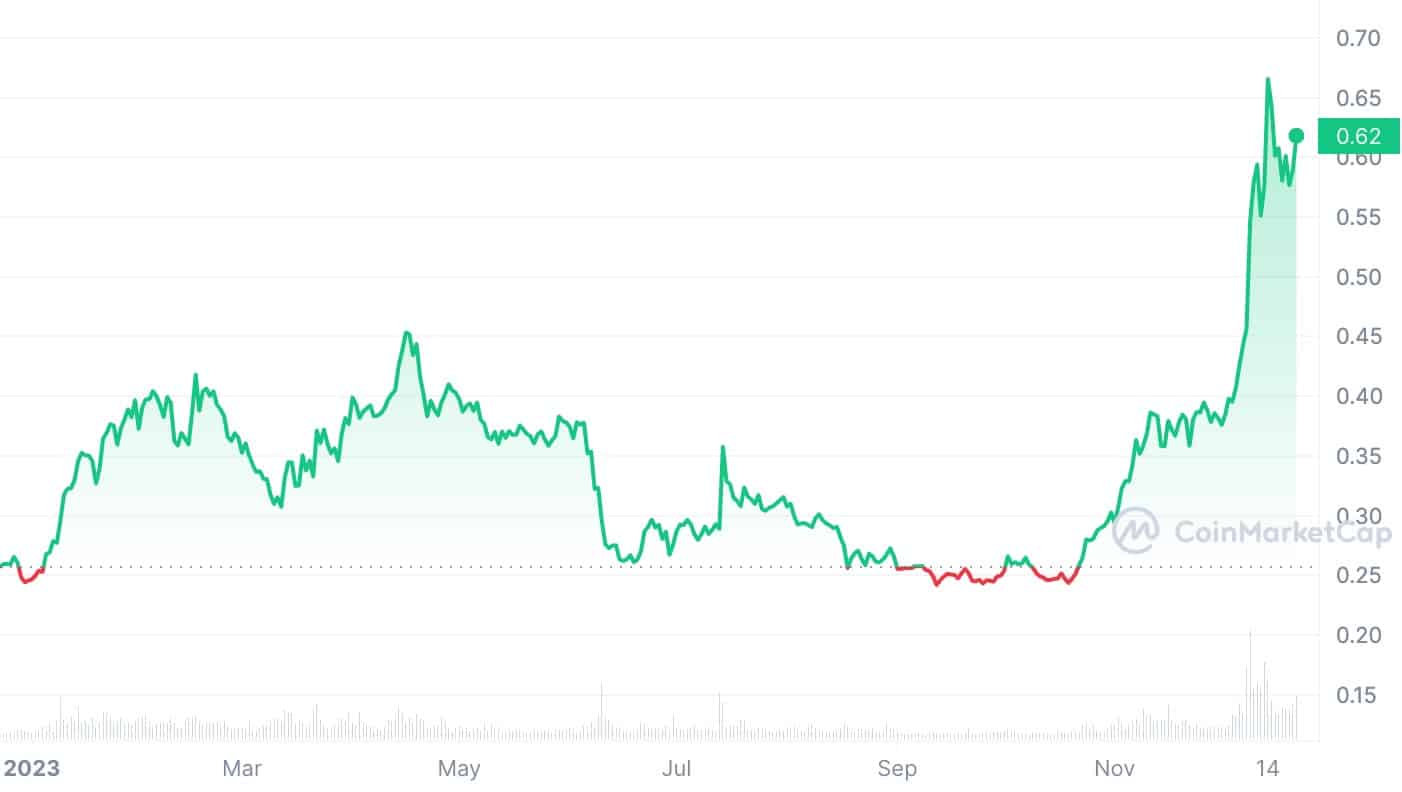

Cardano price in 2023 | Source: CoinMarketCap

Cardano price in 2023 | Source: CoinMarketCap Source: CoinMarketCap

Source: CoinMarketCap