Best performing cryptos 2023: which coins thrived despite regulatory pressure

As we approach 2023, the cryptocurrency market is doing well. Let's see which cryptocurrencies performed the best this year.

Bitcoin price in 2023 | Source: CoinMarketCap

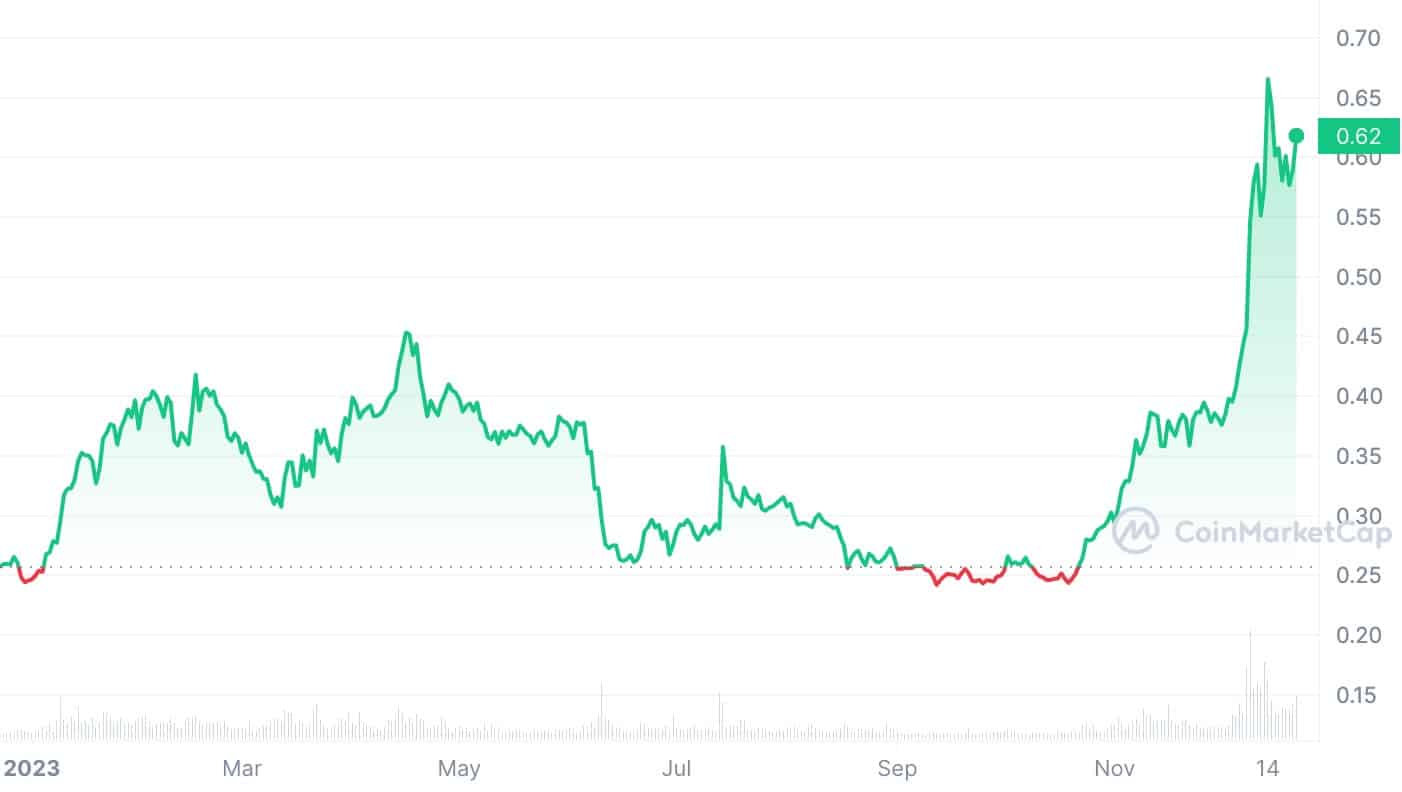

Cardano (ADA): Cardano is a cryptocurrency that saw a surge in interest in early 2023. Its price went from $0.29 to over $0.59 per token, with a total increase of more than 147%.

Cardano price in 2023 | Source: CoinMarketCap

Cardano price in 2023 | Source: CoinMarketCap

Ripple (XRP): Ripple had a roller coaster year, influenced by legal battles. After a partial victory, the token's price shot up to $0.82, marking an 80% increase in a year.

XRP price in 2023 | Source: CoinMarketCap

Tron (TRX): Tron is a decentralized cryptocurrency gaining popularity. Its price increased by 91% over the past year, and it's notable for its transactions in the USDT.

Tron price in 2023 | Source: CoinMarketCap

Tron price in 2023 | Source: CoinMarketCap

Ethereum (ETH): Ethereum is a promising altcoin known for its innovative focus. Its price grew by more than 96% this year, making it a popular choice for developers.

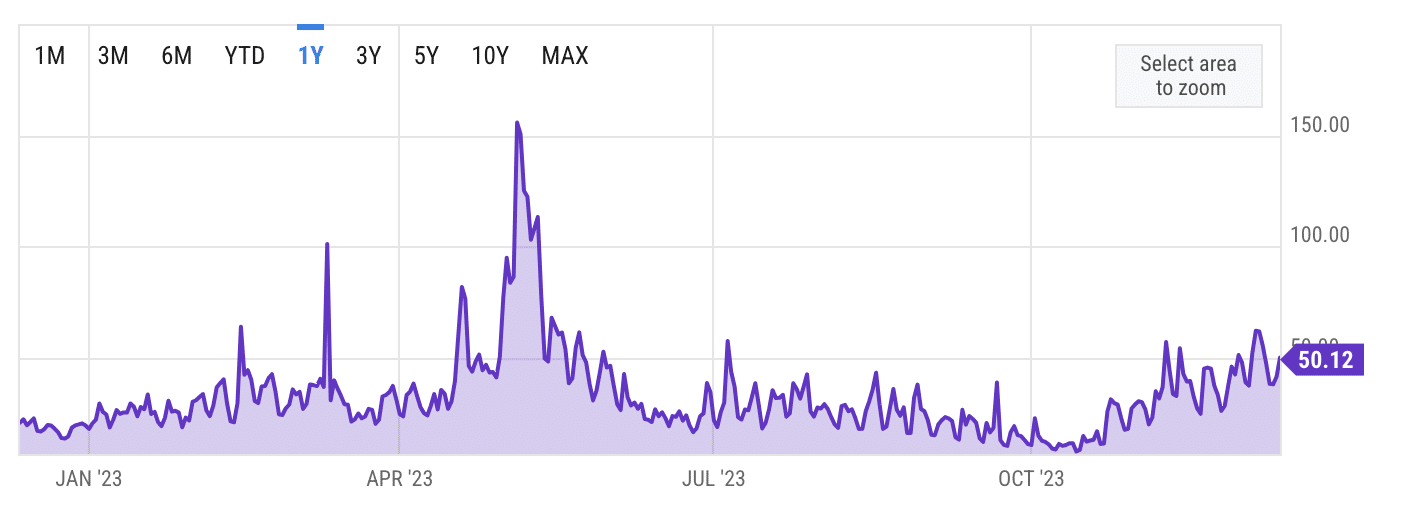

Ethereum gas fees | Source: YCharts

Ethereum gas fees | Source: YCharts

Solana (SOL): Solana reached a new yearly high of $95.4 in December, with a remarkable price surge of over 711% throughout the year. Despite challenges, Solana's survival and recovery enhanced its appeal to investors.

Solana price in 2023 | Source: Solana price in 2023 | Source: CoinMarketCap

Solana price in 2023 | Source: Solana price in 2023 | Source: CoinMarketCap

Looking ahead to 2024, experts predict Bitcoin's halving in April without significant shocks, and Ethereum is expected to outperform tech stocks. Bitcoin's price is forecasted to rise above $48,000 after consolidation, reaching $100,000 by December. Analysts also predict Bitcoin's price to reach $63,140 by April 2024 and $125,000 by the end of the following year.

Related Articles

BlackRock designates JPMorgan, Jane Street as Bitcoin ETF authorized participants

SOL becomes 4th in market cap, overtaking BNB

Chainlink announces top winners of Constellation 2023 Hackathon

SwapToday ©

Source: CoinMarketCap

Source: CoinMarketCap