World Top Web 3.0 Crypto Exchange

Swap crypto with SwapToday Learn More

Over 1000 Cryptos

No KYC for crypto-crypto swap

7+ payment options

170+ Supported countries

ZERO extra cost

50+ Supported fiat currencies

Buy & Sell Crypto Securely

with SwapToday

Choose Crypto

Pick a coin and select the currency of your payment.

Swap

Paste your crypto wallet address and send the deposit.

Get Crypto

Check your wallet and we hope to see you soon??!

Our Strategic Partners

Fast & Secure Crypto Exchange

98%

Triumph Rate

The avarage time for exchange is about 5 minutes. You can track the progress on the exchange page

1M

Satisfied Clients

1000+

Crypto Currencies

170+

Supported Countries

Why choose us?

Because we're not just a platform, we're a revolution.

New standard of security, lightning-paced swaps, a vast crypto universe, unbeatable pricing, an

intuitive interface, 24/7 support system, regulatory compliance, and a commitment to shape the

future of crypto.

Join

Our Most Recent Articles

BlackRock designates JPMorgan, Jane Street as Bitcoin ETF authorized participants

Best performing cryptos 2023: which coins thrived despite regulatory pressure

SOL becomes 4th in market cap, overtaking BNB

SwapToday Reviews

Our Business Partners

BTCUSDT.Social

Social pool trading game

on Web 3.0 platform.

VolumeDayTrader

Education platform for professional

stock market trading.

Doctor Papaya

Your partner in crypto price prediction.

SwapToday ©

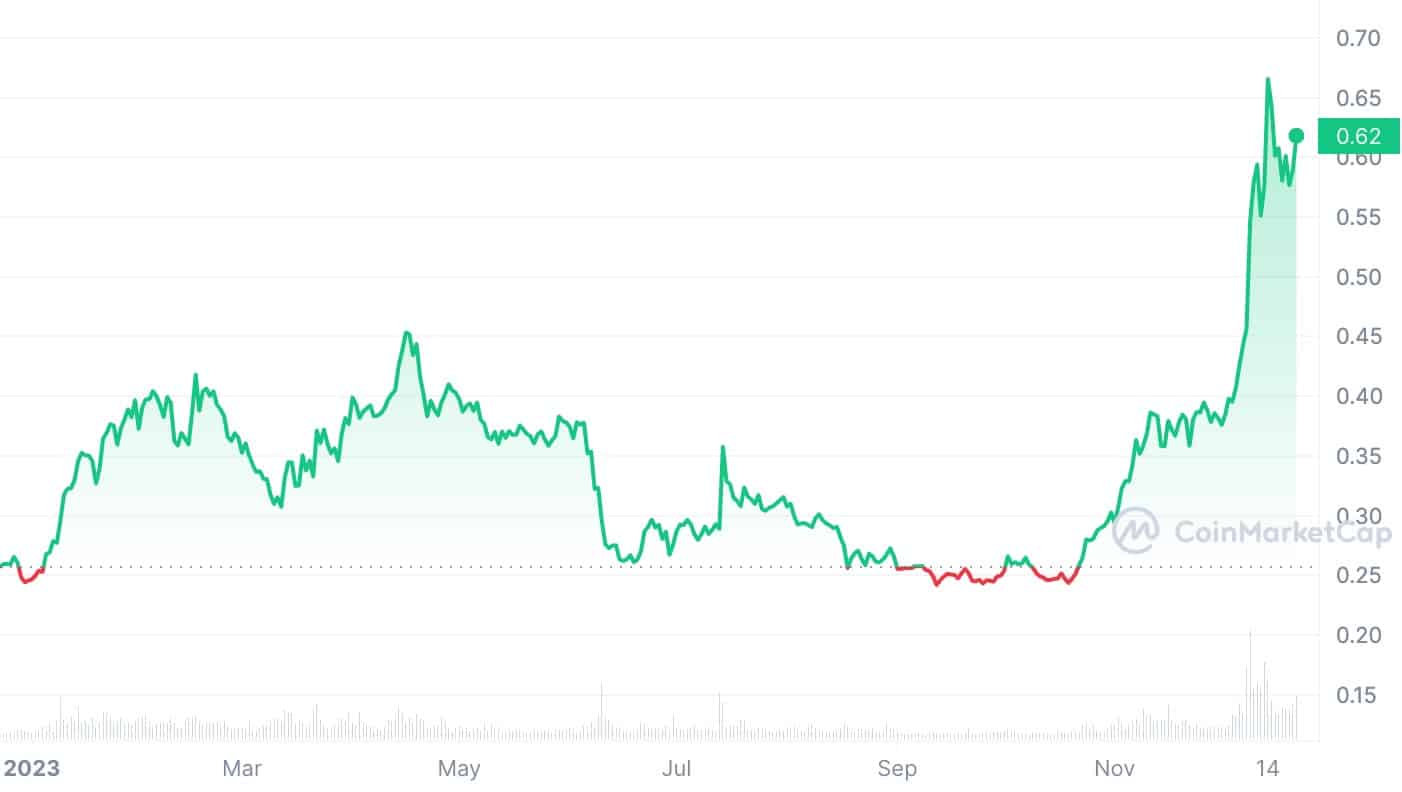

Cardano price in 2023 | Source: CoinMarketCap

Cardano price in 2023 | Source: CoinMarketCap Source: CoinMarketCap

Source: CoinMarketCap